Banking red tape is costing more than 880,000 Australian SMEs four weeks’ productive work time a year and the national economy close to $7 billion annually, equating to an extra 20 working days a year or the entire annual holidays of the average employee.

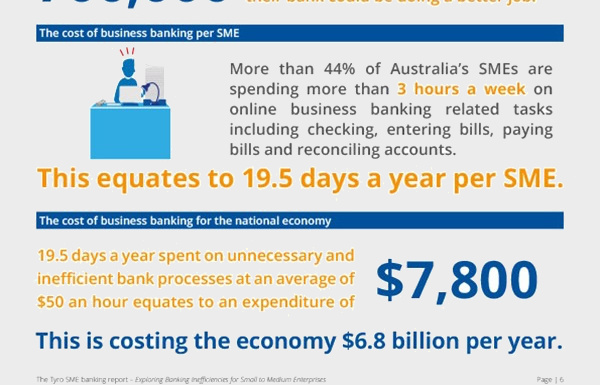

According to research by Tyro, 44 per cent of SMEs spend more than three hours every week checking, entering, paying and reconciling data, which costs each business an average of $7,800 a year.

The Exploring banking inefficiencies for SMEs report also found that 50 per cent of owners and operators are doing their own bookkeeping and 20 per cent don’t use any form of accounting software.

Tyro CEO Jost Stollmann says that SMEs are the creative and innovative heart of the Australian economy, generating more jobs than any other sector.

“Large companies, with more than 200 employees, make up only 0.3 per cent of businesses operating in Australia,” he explains. “However, SMEs are drowning under the burden of inefficient online business banking processes, that are robbing them of three hours a week, or 20 days a year.

“This means SMEs have to work a 13-month year, or give up the equivalent of four weeks’ annual holiday to compensate for banking inefficiencies.”

Stollmann says efficient online banking was critical to the success of SMEs and many of them feel their bank is letting them down.

“Banks need to try harder to reduce the burden on Australian businesses. It is clear that business banking requires a rethink. It needs to be mobile, embedded into business and accounting software and fully automated.

“The winners in the business banking of the future will marry deep technology and banking know-how.”

Billions of dollars have been spent by the private and public sector to assist SMEs, particularly around improving workplace participation. However, very little has been done to address the issues of access to capital or business and banking improvement processes.

Stollmann says SME banking was an industry in transition, and the major providers needed to make it easier for customers to do business.

“Australia’s small and medium sized businesses are developing into the most attractive banking customers in the country.

“From a market that was once considered very niche and challenging to serve, SMEs have now become a strategic target for banks.

“This flows on from the 2008 financial crisis, when banks began to shift their focus away from large corporates in an effort to seek high yields in a low interest rate environment. Banks now see SMEs as core to their business.”

Commonwealth Bank of Australia (CBA) CEO Ian Narev acknowledges the fact that for CBA it is either innovate or die.

“If we don’t innovate successfully, we’re toast,” Narev recently told free-market think tank The Centre for Independent Studies.

“Not we’ll lose a bit of profit, we’ll lose a few customers—we’re toast. And I’m talking over a decade, not over six months, but it is an existential imperative for us to innovate.”