Digital disruption and poor household income growth curbing growth in spending are some of the greatest operating challenges for the retail sector, research has revealed.

According to Deloitte’s latest quarterly Retail Forecasts report, real retail turnover growth was 2.6% for the year to March 2018 while overall real retail turnover is expected to lift from 2.4% in 2017-18 to 2.6% in 2018-19.

Digital disruption continues to be the greatest challenge for the retail sector, according to the report, which notes that the introduction of competition from online retailers presents an additional challenge for the sector.

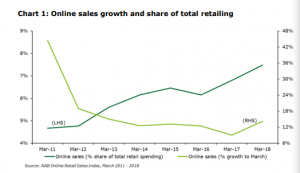

Despite a moderation in the rate of growth, evident in the graph below, spending online continues to significantly outpace that experienced by traditional bricks and mortar retailers, the report said.

The prevalence of online retailers overseas and the continual disruption caused by online platforms is also continuing to place pressure on the sector to bring down prices, according to Deloitte Access Economics partner David Rumbens.

“Regardless of category, retailers that offer omni-channel solutions, create brands that align with consumer values, and harness new paths to purchase will be the longer term winners,” he said.

“With GST not payable on smaller purchases from overseas online platforms, some domestic retailers believe they have been at a disadvantage when it comes to prices and margins. But this is about to change, and the industry will be watching closely as GST on these smaller purchases comes into effect on 1 July.”

“Amazon’s announcement that it will not collect GST on Australian purchases, and restrict locals to the smaller offering of its recently launched Australian site has made the headlines. But others are, perhaps reluctantly, embracing the change.

“This may cause some consumer angst in the short-term, but overall the policy will support a more level playing field for the retail sector.”

Housing slow-down and population growth

The slow pace of growth is a result of the slow-down of the housing market, Mr Rumbens said.

“Current growth is being driven primarily by categories closely tied to the housing market which have benefited from now cooling higher property prices, while intense competition in apparel and department stores has resulted in falling prices but rising sales volumes,” he said.

“The biggest drag on headline retail growth was food spending, a category closely tied to fluctuations in household income growth which has struggled to pick up over the past year or so.”

While population growth is promising news for the retail sector, e-commerce and household debt will continue to present significant challenges for the sector, he noted.

“Strong population growth also presents good news for the sector, but risks remain around slower wealth accumulation, high household debt, and increased online disruption.”