The $90 billion JobKeeper scheme has officially wrapped up, leaving thousands of Australian businesses and workers feeling nervous about the future.

Despite the turbulent impact of Covid-19 on the local economy, there has been an emergence of innovative small businesses with ASIC research revealing a 33% increase in new business registrations during the pandemic.

While the pandemic forced too many Australian small businesses to close, seeing how many people kickstarted a new business and took the leap to work for themselves has been positive, according to David Fairfull, CEO and co-founder at marketing software company, Metigy (pictured below).

“We know that research from ASIC shows the number of new business registrations skyrocketing during the pandemic, with 48,128 registered in the year to July, up from 36,024 the previous year,” he said.

“And as JobKeeper payments come to an end, I believe the growing trend of microbusiness owners getting their products or services off the ground is set to continue. Aussies make very creative, determined entrepreneurs so I expect we will see some amazing businesses borne from adversity.”

Fairfull said while the adoption of technology and digital tools may be lower down some priority lists when starting a small business, these investments can make the world of difference.

“From driving efficiencies with fewer resources, targeting new digital audiences and getting your product or service in the right hands, the time to invest has never been greater,” he explained.

“Taking inspiration from one of our closest neighbours, Singapore, encouraging adoption of digital solutions among SMEs is anticipated to play a role in boosting economic recovery. In its recent Budget, the government set aside $1 billion to pump into digital transformation schemes, including the adoption of digital solutions and new technology, explicitly for SMEs.

“Small businesses in Australia need the same backing. As we prepare for future economic security, taking a leaf out of Singapore’s books – and actively encouraging a digital-first future – could be a vital step in supporting our rising microbusinesses at this critical moment, which for many is make or break.”

Fairfull’s comments were echoed by Lars Leber, vice president and country manager at accounting software company, Intuit QuickBooks Australia, who believes the way forward for small business is to prioritise digitisation.

“While economists argue that the economy is well-prepared for the end of JobKeeper, the reality is that many small businesses across the country are still concerned about their survival,” Leber said.

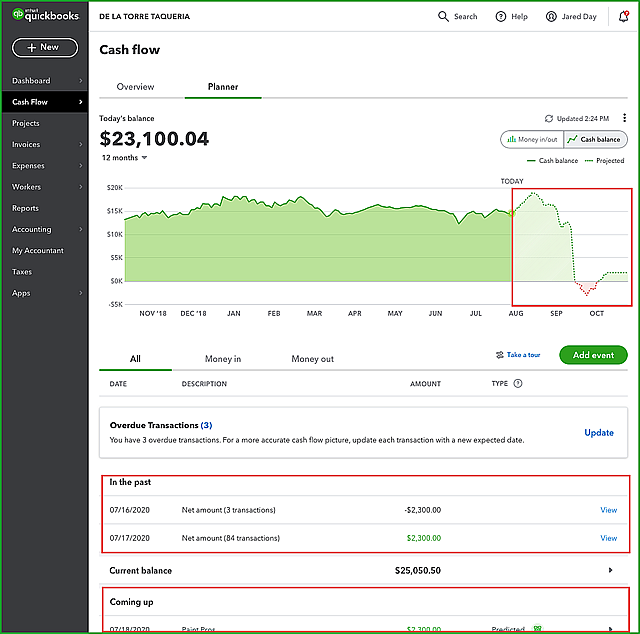

“One way for them to safeguard their cash flow is through further digital adoption to optimise their processes, building on the acceleration of their online presence for customers during lockdowns.

“The digitisation of key functions like finance can simplify the process for SMB owners and managers, provide greater view over a business’ financial situation and insight into cash flow and upcoming financial obligations. This enables businesses to be on the front foot and frees up time to focus on things like finding new ways to grow their business,” he added.

Intuit Quickbooks recognises the value in schemes like the Victorian state government’s Small Business Digital Adaption Program, as a sustainable way to support the sector following the end of JobKeeper.

“A disproportionate number of SMBs, compared to larger businesses, counted on JobKeeper to get them through the worst of the pandemic and typically have less capital available to invest into tech-led solutions.

“I encourage both state and federal governments to consider similar longer-term initiatives such as the Digital Adaption Program, providing financial support for SMBs that demonstrate willingness to modernise their operations.”

Small businesses remain uncertain despite promising signs of confidence

A national survey of more than 1,200 small businesses has found signs of improved SME confidence, although many businesses remain uncertain about their road to recovery.

The March 2021 ScotPac SME Growth Index recorded two positive signs of small business recovery – more owners are planning to invest in their businesses in 2021 compared to last year, and there has been a significant rise in average revenue growth forecast for the first half of the year.

ScotPac CEO Jon Sutton said the Index recorded an eight-point rise in average SME revenue growth forecast for the first half of 2021, reflecting a strong bounce back in confidence for many businesses.

Sutton said these green shoots are a promising sign that the small business sector as a whole has withstood the worst of the economic impact of a one-in-100-year crisis.

“After a year facing pandemic and recession, there’s now a sense of SMEs really wanting to get back to business as usual,” he said.

“But despite these positive signs, our research shows the recovery is uneven and varies significantly by state, region and industry. There are still many small businesses who are doing it tough.”

The study asked SMEs about their strategies for recovery and growth in 2021. Two-thirds of small businesses (65%) say they will make changes to the structure of their business in 2021, in order to recover from the pandemic or to take advantage of opportunities.

“This SME intention to restructure includes looking at other ways to fund their businesses,” Sutton said.

“I believe business owners are on the right track with this intention, because to be in a position for recovery and growth it’s essential to have adequate funding in place.”

There remains a high level of uncertainty around recovery though with more than one-third (34%) of SMEs saying without significant market improvement they’ll close or sell their business, an increase from 31% who were considering these options in 2020. Only half those polled had no plans to close or sell.

Other signs of SME concern about recovery include: one in four SMEs are unsure about how to recover; almost one in four had cashflow issues after being declined from a lending product; and one in five have cut costs to replace stimulus funds.

When asked how they feel about running their business now compared to before the pandemic, 44% of SMEs expressed confident sentiments while 55% highlighted more pessimistic feelings.