Local fintech, Waave has expanded its product ecosystem with the launch of Wendi, a tool that allows consumers to view their subscription expenses in one place.

Founded by a trio of Australian payments experts, Ben Zyl, Mark Connolly and Peter Traianou, Waave was born out of disillusionment with the outdated and expensive payment systems that dominate the market.

Its flagship product Pay by Bank is a seamless and secure alternative payment method to traditional cards, allowing customers to pay directly via their bank. Pay by Bank reduces merchant payment fees by up to 80% and is the first B2B and B2C payment platform use case of Open Banking in Australia.

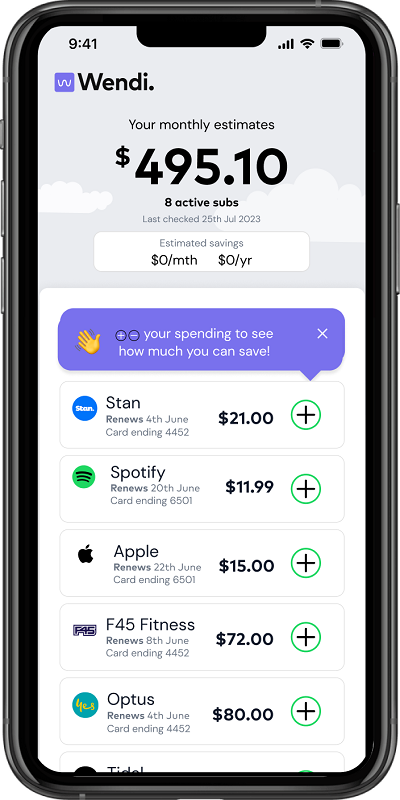

Guided by its purpose to provide full control and visibility, the latest product, Wendi, draws subscription data directly from a user’s bank account, allowing them to view their subscription expenses in one place.

Unlike other budgeting and debt reduction-focused tools, Wendi connects directly to a user’s bank account, does not require them to download an app, does not promote financial products on a commission structure, and does not require a lengthy sign-up process involving ID checks. It is also completely free.

Waave CEO and co-founder, Ben Zyl said, “Waave’s philosophy is built around fairness. Think of Wendi as your trusted financial friend who makes your life better in a safe and secure way. It’s using your data to review and manage your subscription spending, no strings attached.”

When signing up to Wendi, consumers select their bank/s and relevant accounts, and Wendi displays a list of subscription expenses including digital subscriptions, insurance, professional memberships, storage, club associations and health and fitness clubs. Over time, Waave will unlock more interactive features within Wendi and introduce other spending categories such as Buy Now Pay Later, ‘gig economy’ spending and bills.

“There is huge scope with Open Banking technology to grow our offering and continue to bring back the connection between consumers and businesses. As technology providers, we have to bridge the trust debt. We are adding transparency, security and simplicity to the digital money economy,” Zyl added.

Signing up to Wendi automatically allows users to access Pay by Bank at available merchants. Waave is currently rolling out Pay by Bank nationally both online and in-store, where it integrates with an extensive partner network including Shopify and other major e-commerce platforms.