Financial technology platform, Adyen has announced major advancements to the in-person payments (IPP) landscape, underscoring its commitment to innovation.

Adyen vice president product for payment channels, Derk Busser said, “Adyen offers an industry-leading in-person payment solution, with one of the widest product portfolios in the market, ranging from mobile solutions to countertop terminals, catering to any business need—all powered by our single tech stack. This product update is a testament to our ambition in the unified commerce space.

“We see our customers still highly value in-person touchpoints and we are continuing to differentiate ourselves within the payments industry to be the market leader in omnichannel solutions. We’re committed to revolutionise how the shoppers of today and tomorrow experience ‘the store’.”

The new Adyen SFO1 proprietary multimedia countertop Android terminal features an 8-inch touch screen and integrates functions of traditional terminals with customer-facing displays.

“The SFO1 will fundamentally change the way brands interact with customers at the point of purchase,” Busser added.

“Rich video content allows fashion retailers to showcase next season’s collection on stunning screens while offering shoppers the chance to sign up for loyalty programs to receive discounts or early access to the clothing shown. We’re pushing the boundaries of innovation, ensuring that merchants can provide cutting-edge, customisable in-store checkout experiences.”

SFO1 allows enterprise and platform businesses to maintain consistent brand presence and engage customers by seamlessly integrating with their point of sale (POS) systems or partners, while reducing counter clutter and costs.

Adyen was the first to introduce Tap to Pay solutions on a global scale and is now expanding its Tap to Pay on Android capabilities into Europe, the UAE, Hong Kong, Malaysia, Australia and New Zealand.

Adyen’s Tap to Pay on Android solution transforms any NFC-enabled Android device into a secure payment terminal, eliminating the need for traditional POS hardware. This reduces upfront costs for merchants and offers greater flexibility in accepting payments. Adyen is also one of the first to offer a comprehensive software development kit (SDK) and payments app.

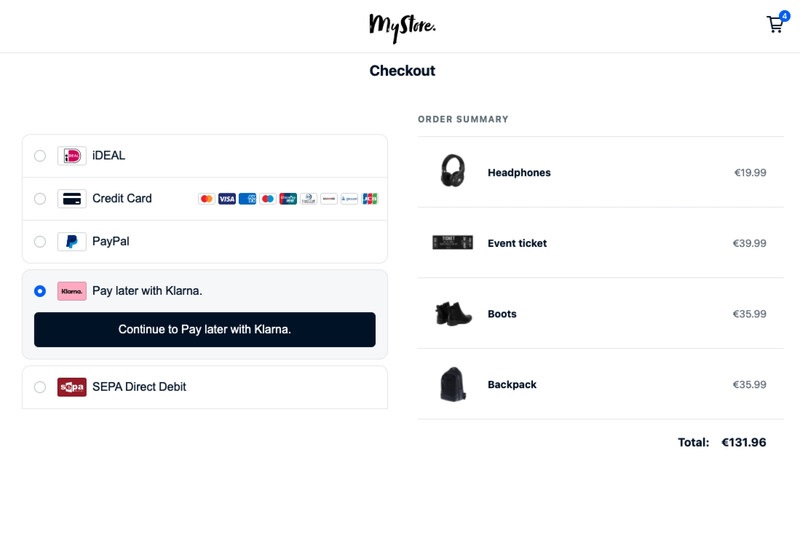

Adyen has also become the first global payment service provider (PSP) to launch Klarna’s in-store solution and initiate the global rollout of Alipay+ on its terminals.

Buy-now-pay-later (BNPL) services are projected to reach $3.98 trillion by 2030, according to Allied Market Research, and with the dominance of digital payment solutions like Alipay+, Adyen’s integration allows merchants to reach a broader global audience. By enabling Klarna and Alipay+ in-store, Adyen offers the flexibility for customers to choose their preferred payment method regardless of the shopping channel.