With the impending arrival of Amazon to Australian shores, there have been questions about how it will impact shopping centre traffic.

While acknowledging the online behemoth will change the face of retail as we know it, the extent of that change needs to be put into context of shopping trends unique to Australia.

The doomsayers have painted the arrival of the global retail giant as a major game changer.

Sure, it may introduce a new level of speed, supply chain accuracy and an enhanced online shopping experience. But there are a number of factors that will hinder Amazon from reaching the heights in Australia that it has in the US.

Shopping centres have become leisure destinations.

These include Australia’s conservatism towards online shopping and the massive investment into improving the look and feel of Australian shopping centres to create a leisure destination where shoppers can dine, socialise, access services, be entertained and of course, shop. Then there is also the fact that shopping centres are viewed as the ‘pantry’ for most Australian households.

The threat of online shopping rocking the foundations of bricks-and-mortar stores has been a topic of conversation for many years, with the rationale that people needn’t leave their home when they could shop from the comfort of their armchairs. But the one thing against that proposition is that most Australians like to leave their homes, get out and about and enjoy social interactions.

Despite online shopping being present since 1995 (through sites including EBay and, you guessed it, Amazon.com), the rate of adoption in Australia has not reached the levels of other markets.

Online uptake slower than US market

Australians are conservative online shoppers compared to the rest of the world. KPMG’s 2017 Global Online Consumer Report found only 35 per cent of Australians made their last online purchase from an online-only retailer compared to 50 per cent globally.

And while online sales as a percentage of all retail sales are inching towards 10 per cent in the US—according to Y Charts it was at 8.3 per cent in December 2016—estimates from the Australian Bureau of Statistics suggest that as of February this year online sales account for just 3.6 per cent of Australia’s total retail turnover.

What’s more, this is a softening from the recorded peak of 4.1 per cent in November 2016.

When it comes to grocery sales, the penetration of online transactions is similar. According to IGD’s 2015 Retail Analysis report, online sales accounted for 2.3 per cent and are forecasted to just hit the 4 per cent mark in 2020.

Australians are not only conservative online shoppers. They are also social creatures who like to be out and about in their community and a trip to the shopping centre is more than just shopping. For some it is entertainment and for others an opportunity to catch up with friends.

Research that oOh!media undertook with The Seed identified seven types of shoppers, each motivated by different drivers. It found even those described as ‘chore-haters’ who just want to get their shopping done got a level of enjoyment from going to the shopping centre.

Shopping centres as community hubs

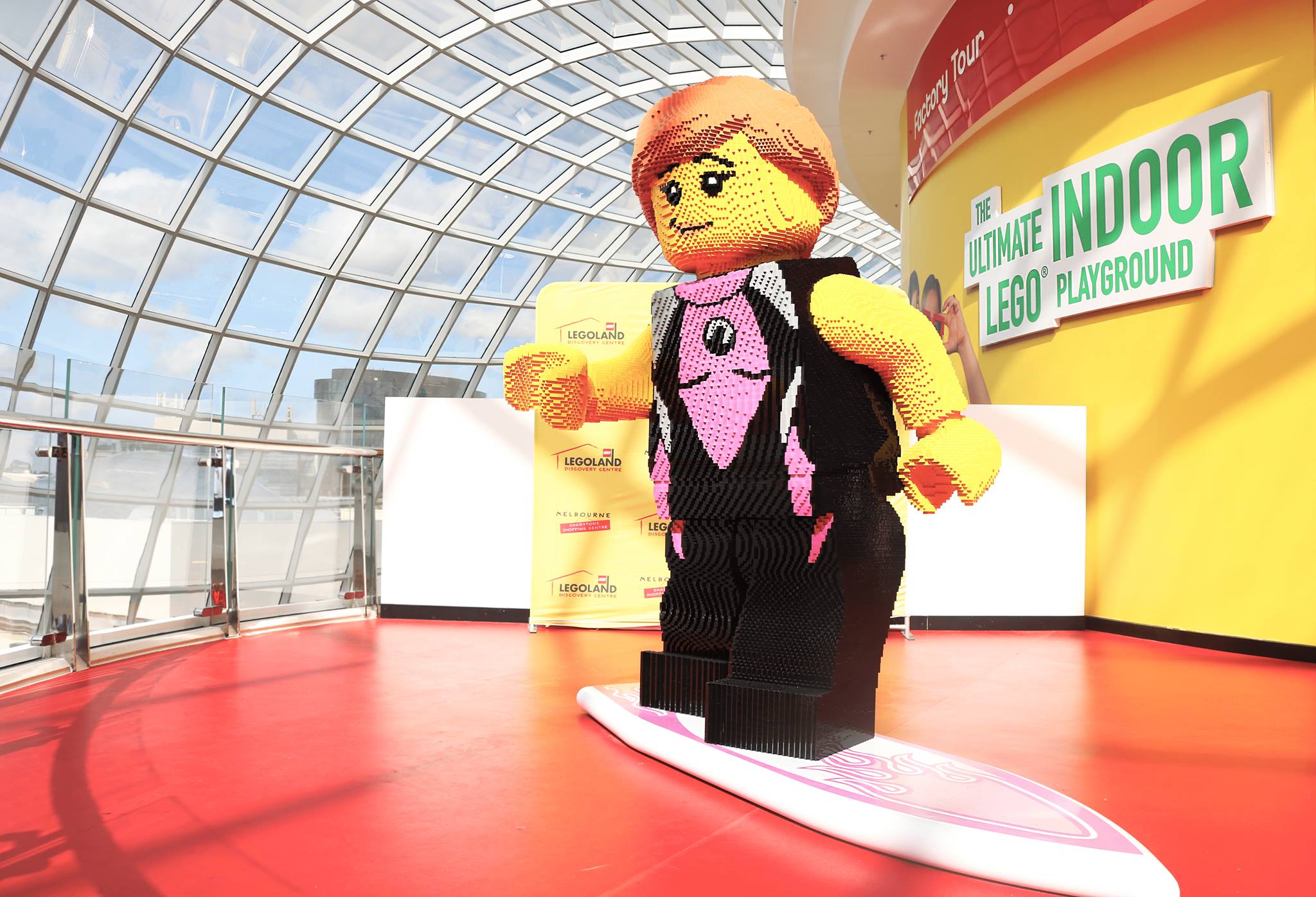

Legoland at Chadstone shopping centre in Victoria, via Facebook.

The shopping centre industry understands the role their properties play in society and has invested to create environments that shoppers enjoy. Billions have been invested in refurbishing and extending centres to meet demand.

The Gold Coast’s Pacific Fair for example, has undergone a $670 million make over by AMP Capital to make room for 120 new specialty retailers and a high-end luxury precinct, all encapsulated in a five-star holiday resort ambience with a unique indoor/outdoor environment reflecting the local lifestyle.

AMP Capital has also completed a $440 million development at Macquarie Centre in North Ryde, Sydney in recent years, with plans for a further $1 billion redevelopment of residential housing and 5,000 square metres of dedicated community space including a library and public creative hub.

Shopping centre owners have also been inventive with the types of retailers and service providers that become tenants.

Victoria’s Chadstone shopping centre, for example, has just become home to Australia’s Legoland Discovery Centre, and when QIC developed Eastland in Ringwood, Victoria, it had the vision of creating a true town centre.

The power of retail will continue

The Macquarie Centre in North Ryde, Sydney.

The future of retail remains strong. Shopping centres will continue to play a significant role in the life of Australians well into the future, for shopping, entertainment and social connection.

We will continue to enjoy the tactile experience of shopping—picking out our own fresh fruit and vegetables, trying on clothes and having sales staff on hand to help inform purchases.

Blair Hamilford is the commercial director of retail sales at oOh!media. He has over 15 years’ media sales experience in Australia, the last five leading and growing oOh!’s retail media channel.

Blair Hamilford is the commercial director of retail sales at oOh!media. He has over 15 years’ media sales experience in Australia, the last five leading and growing oOh!’s retail media channel.