The average vacancy rate among shopping centres across the country is at its highest level in eight years.

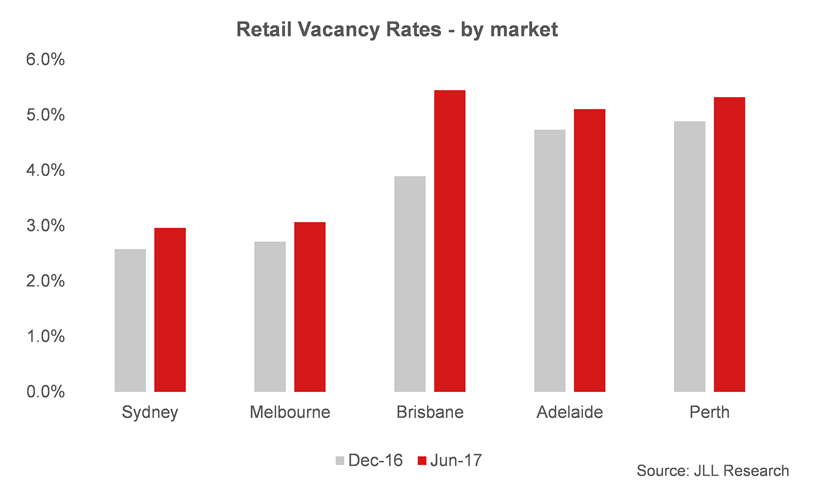

Nationally, the shopping centre average vacancy rate—excluding CBD retail—rose from 2.6 per cent in December 2016 to 3.3 per cent in June 2017, according to new figures from JLL.

The CBD rate decreased slightly—from 6.8 per cent to 6.3 per cent—but remains significantly higher than other categories, largely driven by higher vacancy rates in Adelaide and Perth.

JLL’s director of retail research Andrew Quillfeldt said the rates were impacted by the relatively high number of retailers entering voluntary administration. The company has tracked the closure of approximately 763 stores over the 18 months to June 2017.

Quillfeldt said rental growth will remain soft in the near future but it will pick up as the economic factors weighing on retail spending growth eventually fade.

“There is a cyclical component to the current conditions,” he said. “The housing market is less of a driver than it was in previous years, wages growth remains subdued and new market entrants driving competition-led discounting among retailers has kept inflation low or negative.

“We expect rental growth to remain muted in the short-term but the fundamental drivers of strong population growth for a mature economy and employment growth will be supportive over the medium term.”

CBD retail remains most robust

CBD retail was the only category on a national basis to record a decline in the vacancy rate in the first half of 2017. This was largely driven by the Sydney CBD, which decreased from 3.9 per cent in December 2016 to 3.3 per cent in June 2017.

While CBD retail remains the most robust from a leasing demand perspective, the decrease in the Sydney CBD vacancy rate was also impacted by withdrawals for development, partly offset by disruption caused by construction work on George Street.

Sydney and Melbourne continue to record the lowest vacancy rates, with Adelaide, Perth and Brisbane remaining elevated at above 5 per cent.

“In terms of the outlook, Victoria is well-placed to record stronger retail spending conditions, given the state’s strong population growth of 2.4 per cent per annum,” Quillfeldt said.

“On a medium-term view, there is potential for a recovery in retail conditions in Queensland given the upside potential for population growth through stronger interstate migration. Conditions are likely to remain subdued in Western Australia given the ongoing economic adjustment, combined with high retail supply pipeline.”

Landlords turning to technology

As bricks-and-mortar retailers rapidly seek new ways to use technology to grow and strengthen their business—whether it’s through ecommerce, digital wallets, virtual concierges, social media engagement or ‘click and deliver’ services—many landlords are also thinking about how to future-proof their businesses through technology, said JLL’s Australian head of retail, property and asset management, Tony Doherty.

The recently refurbished Chadstone shopping centre in Melbourne.

“Owners of retail assets are very focused on the long-term themes impacting shopping centre performance, especially technology,” he said.

“Landlords have to be responsive to the changing environment and provide the best possible places for people to shop, socialise, and dine.

“A re-development upswing is underway as owners reconfigure and refurbish shopping centres to install technological infrastructure for customer analytics, to provide upgraded and expanded dining precincts, and to introduce new brands and services to their centres.”

For the owners who can adapt, using technology is an opportunity to differentiate their centres, he said.

Construction continues

Despite the high vacancy rate, project commencements increased in the second quarter of 2017, with approximately 146,000-square-metres starting construction in the three months to June 2017, including a range of regional, sub-regional and neighbourhood centres.

Vicinity Centres’ DFO development at Perth Airport (24,000 sqm) was a major contributor to the total, along with the refurbishment and extension of Bonnyrigg Plaza (23,600 sqm). Vicinity also started construction on the extension of two regional centres. Vicinity also commenced construction on the extension of two regional centres, including The Glen in Melbourne (18,900 sqm) which is co-owned with Perron Group and Midland Gate in Perth (14,100 sqm).

Want the latest retail news delivered straight to your inbox? Click here to sign up to the retailbiz newsletter.