A leader in ecommerce risk intelligence, Riskified has revealed the next generation of its Policy Protect product through the addition of Identity Explore – a new capability allowing merchants to visualise customer identities and behaviour, tailor customer experience and customise policy decisions.

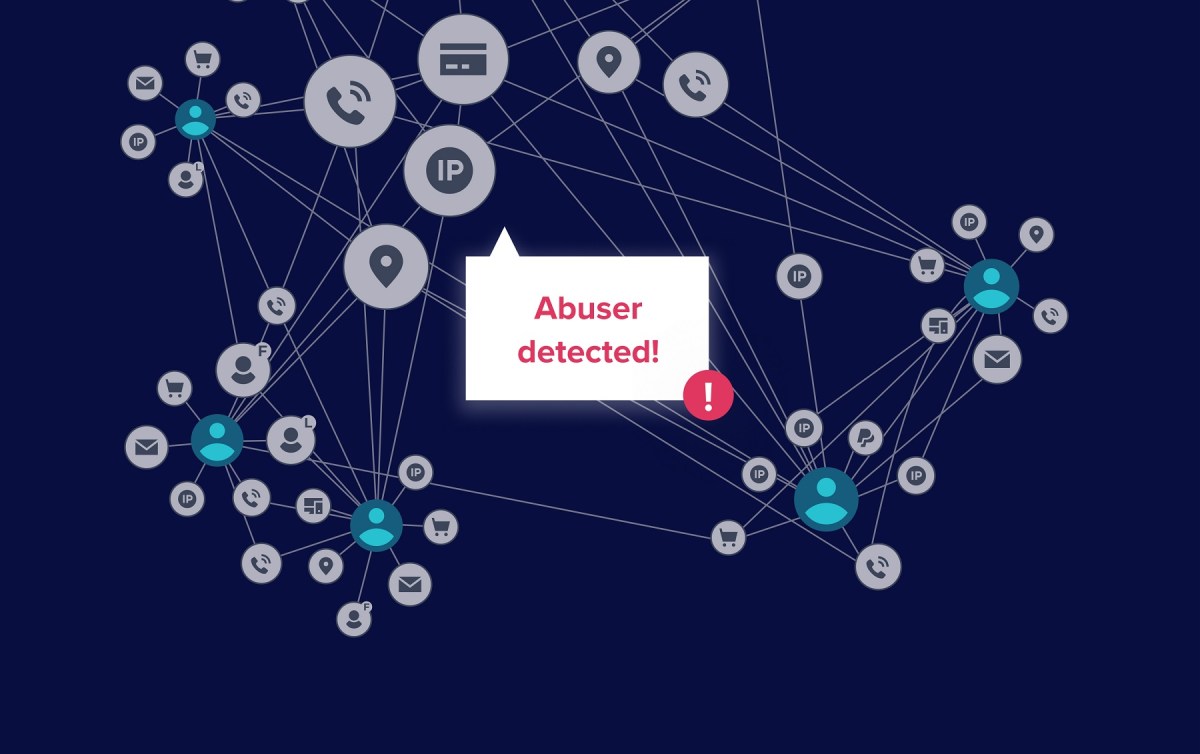

After a decade honing its fraud prevention capabilities, Riskified expanded its platform to help merchants stem significant losses from policy-related abuses. Policy Protect uses machine learning to detect and prevent policy abuse in real-time. It is powered by a proprietary engine that forms identity clusters from billions of accounts, behaviors and transactions across a global merchant network, broadening the view of customer identity beyond their singular profile with a merchant.

Identity Explore presents a major leap forward through a high-resolution visualisation of Riskified’s identity engine, giving merchants the ability to analyse, investigate and interact with customers on a new level.

“It’s a supreme balancing act for merchants to provide generous policies to shoppers while keeping an eye on the bottom line. With Policy Protect, we’re empowering merchants to feel free to be lenient with their loyal customers while stopping abusers, and losses, with pinpoint accuracy,” Riskified chief technology officer and co-founder, Assaf Feldman said.

“Identity Explore takes us an exciting step further, giving merchants instant insight into who is a good customer and who is not, so that they can apply the right policy, to the right customer, at the right time.”

Using Policy Protect, many leading retailers have saved millions of dollars blocking policy-related abuses. Merchants have been able to prevent 15x more abusive returns and refund claims, detect nearly 95% of unauthorised resellers and save 70% of their promotion budget.