With fewer people visiting shopping precincts, centre operators are looking for other ways to increase foot traffic.

According to new IBISWorld research, frugal consumers and online shopping have reduced the number of people going to shopping centres and therefore retail centres need to offer an even greater range of shopping and services.

“Digital platforms that enhance in-store customer shopping experiences and eliminate the divide between bricks-and-mortar and online operations are also part of retailers’ attempts to increase footfall,” said Kim Do, IBISWorld senior industry analyst.

“It is likely that shoppers will experience diversifying tenancy mixes at their local shopping centre, which are expected to include a greater range of lifestyle services, such as health and beauty services, dine-in restaurants, cinemas and bowling alleys. Temporary novelties such as concerts, galleries, pop-up shops, showrooms and concept stores are also expected to become more common in Australia’s shopping centres.”

Christmas is one of the busiest shopping periods of the year; however, annual retail revenue is expected to increase by just 1.9 per cent over the year to December 2017, according to the report.

Christmas is one of the busiest shopping periods of the year.

“Trading conditions are forecast to remain challenging across the range of bricks-and-mortar retailing and service industries commonly found in Australian shopping centres, with annualised growth of between one and 2.2 per cent over the five years through 2022-23. Online shopping, however, is anticipated to enjoy annualised revenue growth of 9.4 per cent over the same period.”

Many international retailers, such as Marks & Spencer, River Island, Next, Nordstrom, and Macy’s, have launched online ordering platforms in Australia in recent years, which has put additional pressure on Australian enterprises.

According to IBISWorld, the ability of shopping centres to sell themselves as an entertainment destination during the holiday period will be a key factor in increasing shopping centre traffic.

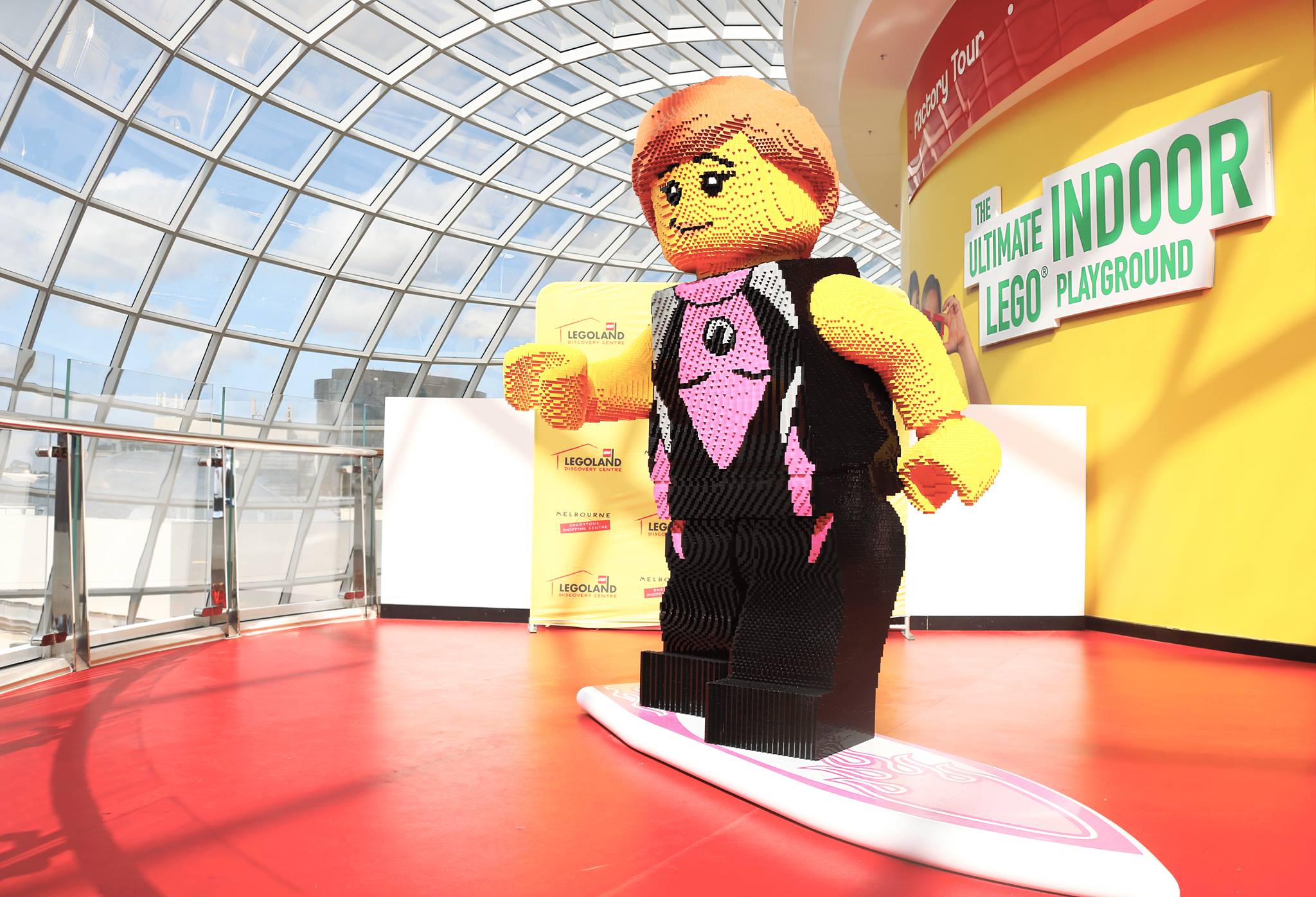

“Many large shopping centres have already adopted this approach. For example, the first redevelopment stage of Chadstone shopping centre in Victoria included a new dine-in restaurant precinct, a renewed cinema and a LEGO Discovery Centre, with future plans including a hotel,” said Do.

“Similarly, Highpoint shopping centre has announced plans to create a town square with the potential to include a hotel, medical centres and more entertainment spaces.

Melbourne’s Chadstone shopping centre has opened a LEGO Discovery Centre.

Also, online shopping can actually present new opportunities for innovative marketing techniques.

“In addition to expanding tenancy mixes, shopping centre operators are expected to work alongside retailers to enhance customers’ in-store shopping experiences through leveraging technology advancements and online platforms.”

Some operators, such as Chadstone shopping centre, have announced plans to employ GPS and facial recognition within their centres. The new technology will allow operators to know when consumers have entered the centre and alert them of sales or activities as they shop, tailoring experiences based on each individual.

“Social media, smart phone apps and loyalty programs also present new ways for operators to renew excitement for in-store shopping experiences,” she adds.

This story was originally published by Giftguide.

Want the latest retail news delivered straight to your inbox? Click here to sign up to the weekly retailbiz newsletter.