Leading global fintech platform, Airwallex is launching an online card payments solution in Australia to strengthen its capability to provide end-to-end financial products and services for businesses looking to grow without borders.

First launched in the UK in 2020 and then in Hong Kong earlier this year, expanding its availability to Australia extends the company’s online payments global footprint, further enabling its customers to operate globally.

Through the new solution, businesses have a seamless and secure way of collecting online Visa and Mastercard payments from customers around the world. Businesses can also select from three different integration methods to enhance their digital payment strategy, based on their industry and specific needs.

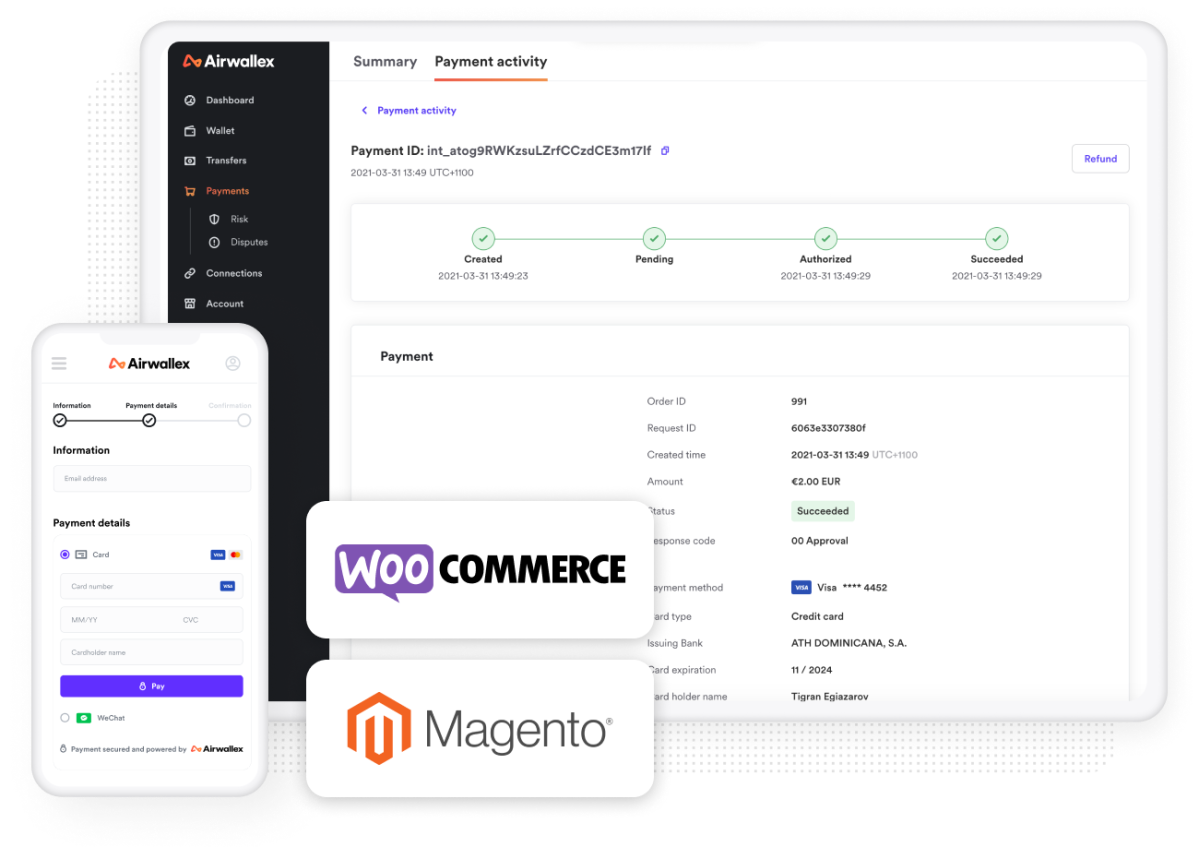

The first method is Get Paid which generates one-off links and issues them to customers for invoice payments; the second is Shopping Extensions which is a suite of plugins that enable merchants using shopping platforms such as WooCommerce and Magento to accept card and WeChat Pay payments; and the third method is API that integrates directly into the organisation’s website and provides a customisable checkout and variety of payment options.

When funds are received in multiple currencies through Airwallex’s online payments solution, businesses can settle in more than eight currencies with zero conversion fees, hold their multi-currency funds in their Airwallex accounts, and spend directly through means such as Airwallex’s debit cards in Australia.

Airwallex vice president and global head of platform, Craig Rees (pictured above) said it is exciting to launch the online card payments solution in Australia as the company looks to strengthen its end-to-end offering.

“Payments are a core part of any business and a highly-requested feature from our customers in Australia. As we look to continue to empower businesses to grow and operate globally, we are focused on helping businesses manage their international payments more efficiently,” he said.

“Our new online payments solution therefore aims to meet their demands, and is designed to enable secure, transparent and cost-effective payment transactions in multiple currencies, while eliminating the need for separate tools and solutions.”