The latest stage of eftpos’ next generation online security technology has gone live with a number of Australian banks, finTtchs and merchants, including Till Payments, Fat Zebra and EFTEX, set to rollout the capability over the next 12 months.

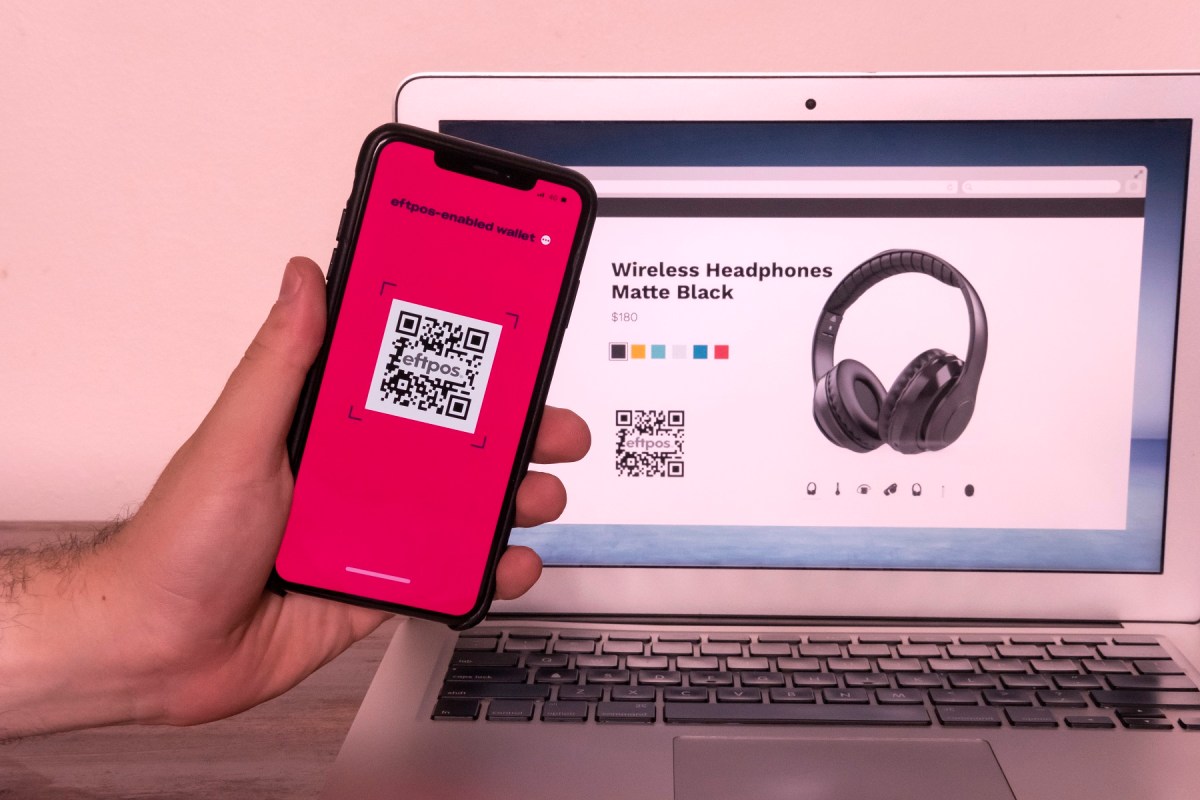

The new eftpos online security capability brings to lifefeatures designed to keep Australians safe online including two factor authentication capability for merchants and their customers.

eftpos’ new sovereign debit scheme online follows the Reserve Bank of Australia’s decision in October that Australian banks are expected to offer and promote Least Cost Routing (LCR) in online by the end of 2022.

eftpos CEO, Stephen Benton said the support of banks, fintechs and payments providers will help the solution scale quickly in the Australian market next year and provide benefits for merchants and consumers, including LCR.

“This is a tipping point for eftpos, online Australian businesses and the Digital Economy and it is great to have partners like Till Payments, Fat Zebra and EFTEX onboard,” he said.

“This is a game changer for eftpos and Australian retailers because retail is quickly transforming to become an increasingly digital marketplace, accelerated by Covid. Big economic benefits could flow from increased competition in addition to enhanced payments security.

“Our suite of world class ecommerce products and services are part of a $100 million eftpos funded digital upgrade to deliver the next generation of secure payments technology.”

eftpos was already available in online for some card on file payments where banks have implemented the service for their merchant customers, and deposits and withdrawal payments via the Beem It mobile wallet.

eftpos’ security kit now includes two factor authentication (3DS), tokenisation, automated disputes and chargebacks and a digital identity solution, connectID, with a new fraud detection engine also going live in the coming weeks.