Intuit QuickBooks has introduced new features to its first-of-a-kind Cash Flow Planner product, including a market-first BAS predictions feature. Using the power of machine learning, the features will help small businesses more accurately plan cash flow for the next 90 days and beyond.

The BAS prediction tool is supported by an invoice prediction tool, extended view for businesses to better manage their money-in for up to 15 months, recurring events tool to easily add repeating events, and mobile planner to access real-time cash-flow data on Apple devices, with Android to follow.

Cash flow continues to be the biggest challenge for small businesses, with more than half (57%) of small business owners identifying this as their number one pain point, according to research from the NSW Small Business Commissioner.

With the new feature updates, the Cash Flow Planner tool focuses further on specific issues to small businesses to become an even more valuable resource.

Intuit QuickBooks director of product management, Mindy Eiermann said it can be challenging to project how much money is coming in and out and to ensure enough is set aside for BAS payments.

“We are excited to launch BAS predictions in the QuickBooks Cash Flow Planner. QuickBooks uses machine learning to predict the GST amounts owed for the upcoming quarter, which means that, for the first time, our customers have real-time visibility into how much money they need to cover critical expenses and the confidence to make smarter business decisions,” she said.

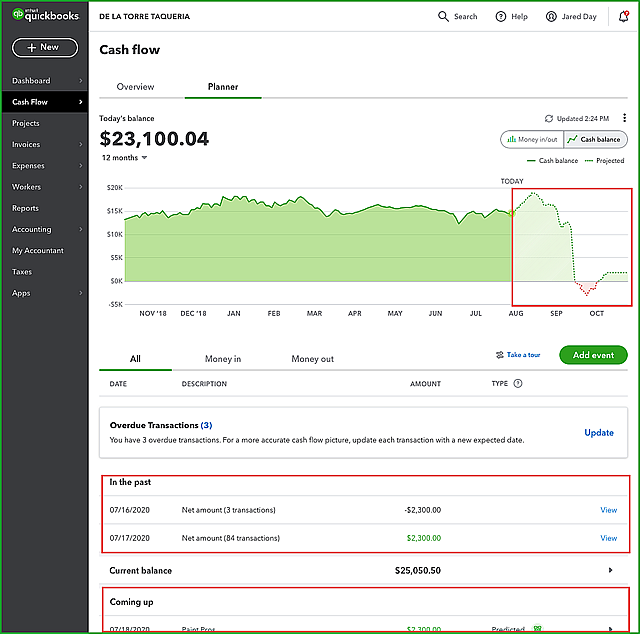

The QuickBooks Cash Flow Planner, launched in mid-2020 to support small businesses feeling the impact of Covid-19, is an interactive tool that forecasts cash flow. It looks at user financial history to predict future money in and money out events.

Users can add and adjust future events to see how certain changes will affect cash flow. Using the power of machine learning, the updated features will deliver accurate results for users, saving them time with oversight and planning of their cash flow.