Business owners are urged to ‘get a grip’ on business costs and focus on profit to avoid margin squeeze. The alternative could be insolvency.

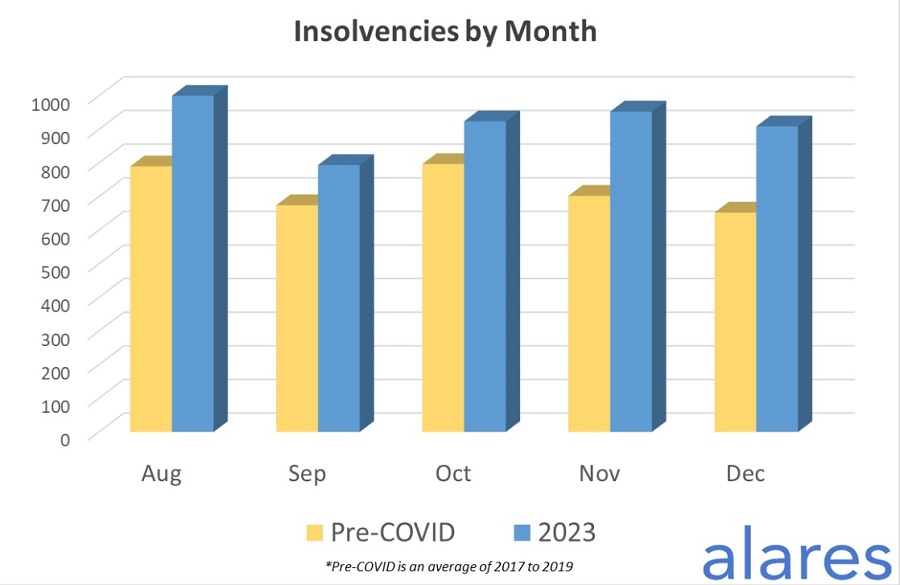

The call comes as the latest Alares Credit Risk Insights shows that Australia’s insolvency numbers in 2023 surpassed the pre-COVID peak in 2018 and 2019 and, in December 2023, Court recoveries and winding-up applications continued their upwards trajectory.

Too many businesses are being forced to chase sales instead of margins and robbing the future to pay for the past.

This isn’t an uncommon pitfall for businesses, but the current market is forcing even experienced operators into making this mistake. We often say that ‘chasing sales is vanity, chasing profit is sanity’. However, in the current environment we know some business owners are feeling the pressure to maintain price points or even discount to maintain top line performance, while the costs of doing business continues to grow, strangling and suppressing their profit margin.

For those businesses with a precarious working capital position or, even worse, legacy debt, this is a recipe for disaster if not quickly corrected. Often the business owner is swimming so hard they do not have time to even take a breath, starving their commercial brain of what is needed to make sensible decisions. This is the point where we are there to help, by providing breathing space to assess the situation and formulate real and long-term options to solve the problem.

A director of an e-commerce retailer cites margin squeeze and the inability to play catch up as a key reason for the company’s financial distress and the need to go into voluntary administration. The director has told me that he felt trapped in a cycle of loss-making decisions simply to keep the lights on. He couldn’t see the forest for the trees – and that’s when he knew he needed help.

Margin squeeze is tricky to come back from; it can ultimately turn what was a profitable business into an unprofitable one. This can seriously impact cash flow because you then have to fund that loss from working capital. That’s why it’s so important to understand your business’s costs and cash needs vs what its true performance looks like. That knowledge enables owners to make good decisions and avoid catastrophic consequences such as poor cash flow management, which can lead to business failure.

Tax debt still dominates

The spectre of tax debt also continues to loom large this year, which could push many more businesses to the edge. The ATO debt level is still significantly higher than pre-pandemic levels, so pressure will continue to mount to bring that back to historical norms.

Bank Court recoveries were well above historical levels in December as higher interest rates continued to impact the serviceability of loans, the Alares report shows. Meanwhile, both ATO and non ATO-initiated winding-up applications continued apace.

The year has started with a bang. Usually, January is a quiet month due to the holiday season and Court closures, but we’ve rolled into 2024 with insolvency enquiries and appointments coming thick and fast. We have many active appointments and strong demand for our services – and we’re likely to see a lot more, as creditors’ attitudes are likely to begin to change.

Since the pandemic, empathy and compassion have been front and centre for a lot of creditors when assessing financially distressed debtors; however, because the spike in insolvencies impacts creditors’ businesses, we anticipate seeing a more robust and active credit collection environment.

A word of advice for business owners in 2024: Address any legacy debt positions in your business as soon as possible by seeking independent expert advice. Some holes are too deep to fill, you need someone to throw you a rope to help you climb out.

Andrew Spring is a partner with Jirsch Sutherland.