MYOB customers now have direct access to receive funds in as little as three hours via a new cashflow and lending hub, as the business management platform deepens its integration with partners, Butn and Valiant.

Recent MYOB Business Monitor research found that almost three-quarters (72%) of businesses who had accessed financing found the process takes too long, and 84% said when they need funding, they need it straight away.

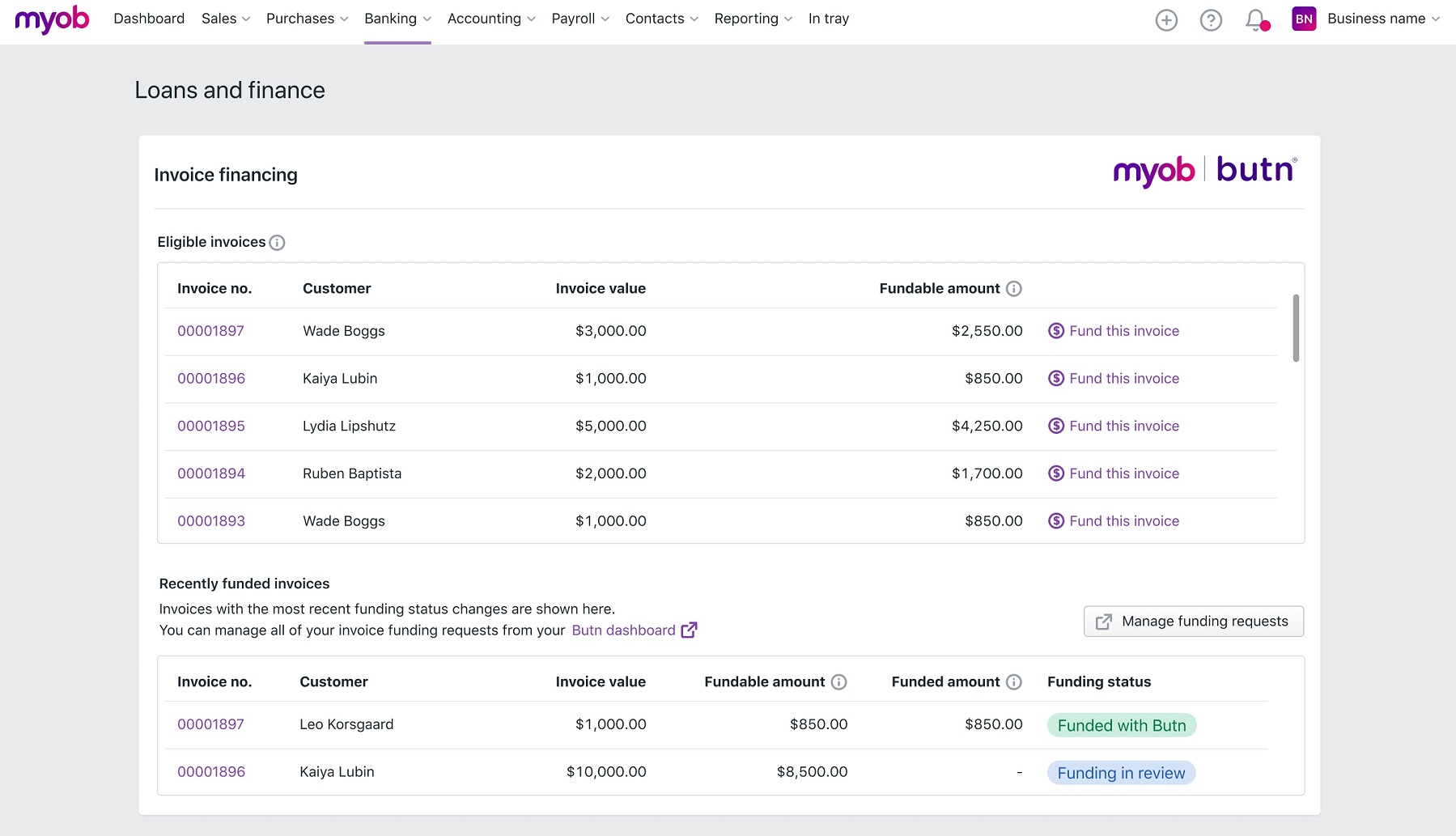

Loans and Finance, available in MYOB Business, provides SMEs with two pathways to improve short-term cashflow and increase funds for longer term growth opportunities.

Invoice financing, powered by Butn, gives businesses early access to funds from issued invoices, prior to their due date. Once the customer has registered, these funds can be released as soon as three hours after applying.

Alternatively, SMEs can receive no-obligation quotes from over 80 lenders within 24 hours, with no credit checks, via Valiant.

MYOB general manager of financial services, Andrew Baines says providing Loans and Finance to customers is key to helping more SMEs maintain cashflow and business liquidity.

“Cashflow is one of the major bugbears for small business owners, and while our recent SME Success Report shows invoice payment times are improving, small businesses often have outstanding payments which can stall business operations,” he said.

“Cashflow inhibitors can have significant impacts, particularly on small businesses. Easy access to loans and finance and, more importantly, fast outcomes in terms of available cash, helps customers take control of their finances so they can focus on running, and building, their business.”