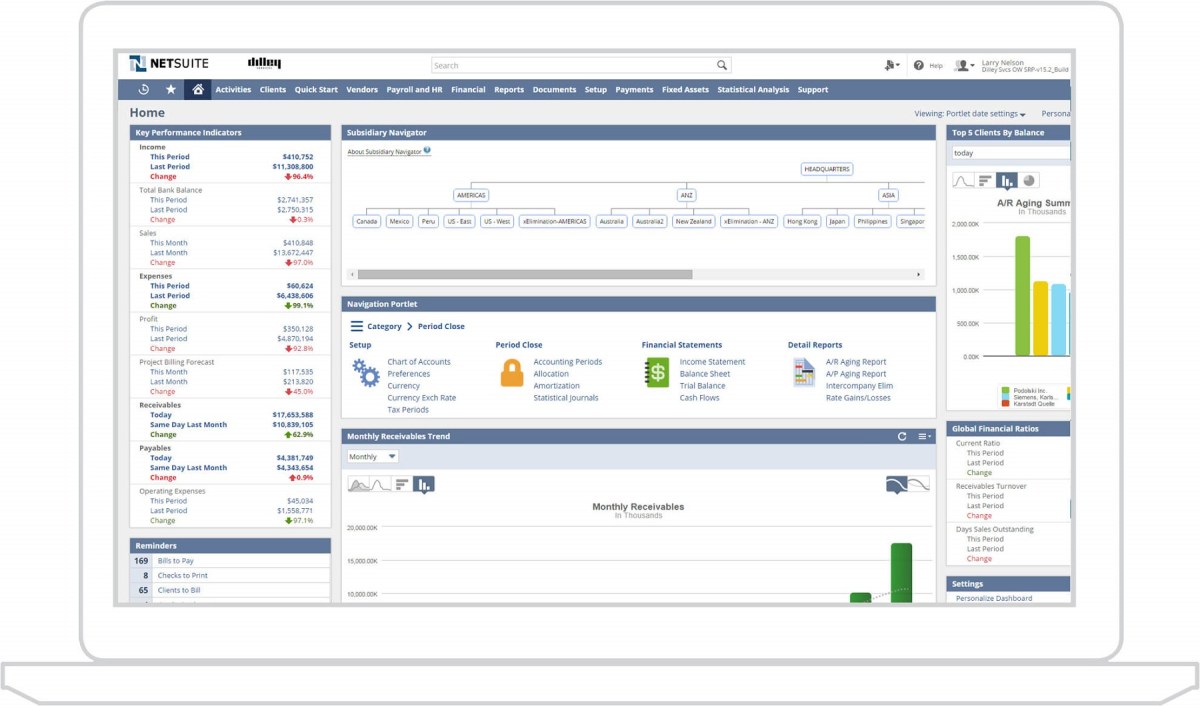

Oracle-owned cloud-based ERP software business, NetSuite, is adding a fintech element to its software, SuiteBanking, as part of a range of new features announced at its recent SuiteWorld event in Las Vegas.

Oracle NetSuite says SuiteBanking will help customers automate key financial processes and gain full visibility into cash flow by bringing together automated accounts payable and accounts receivable processes.

It will allow users to pay bills, send invoices, and get paid all from within NetSuite, also allowing users to customise and set invoicing templates for different third parties based on their needs and preferences.

Additionally, there will be a working capital finance ability built into SuiteBanking, allowing businesses to cover cash flow when needed, as all the financial information is conveniently available to be assessed by the financier within the platform.

In response to RetailBiz’s questions at a recent media briefing, Oracle NetSuite SVP global field operations, Jason Maynard clarified that the financier options will expand as it rolls out, despite only one partner being announced on launch.

“There will be multiple partners on geography and capability. We will be working with different fintech providers to plug in to cover most of the frequently used services.

“For customers running financial information with us, there is information we can share to make credit lending and insurance easier. We will not be in the capital business, it’s not what we’re trying to do, but instead bring these two worlds together,” Maynard says.

Data and information management

NetSuite has also made available the NetSuite Analytics Warehouse, built on Oracle Analytics Cloud and Oracle Autonomous Data Warehouse.

It’s an expansion of NetSuite Suite Analytics that the company is calling “The first and only prebuilt data warehouse and analytics solution for NetSuite customers.”

That is being rolled out alongside its prescriptive playbooks, which use past customer data on NetSuite to help newer customers get the best return on investment on the ERP product.

According to OracleNetsuite, these help to address operational challenges such as revenue recognition, project profitability, and supply chain management, as well as cross-functional processes like quote to cash. The playbooks also support key growth milestones, such as a geographic expansion, IPO preparation, and merger/acquisition activity.

Oracle NetSuite SVP, customer success, David Rodman says, “As businesses grow and face additional complexities, the way they operate must also evolve.

“We’ve taken insights gained from helping thousands of businesses grow and created prescriptive playbooks to share that knowledge with our customers. This will help them improve core business functions and get the most out of NetSuite. Whether a business wants to tighten up internal controls in preparation for an IPO or is looking for a better way to forecast and scenario plan, the playbooks support a wide range of business goals.”