PayPal is introducing new features to its all-in-one platform for small and medium businesses, PayPal Complete Payments (PPCP).

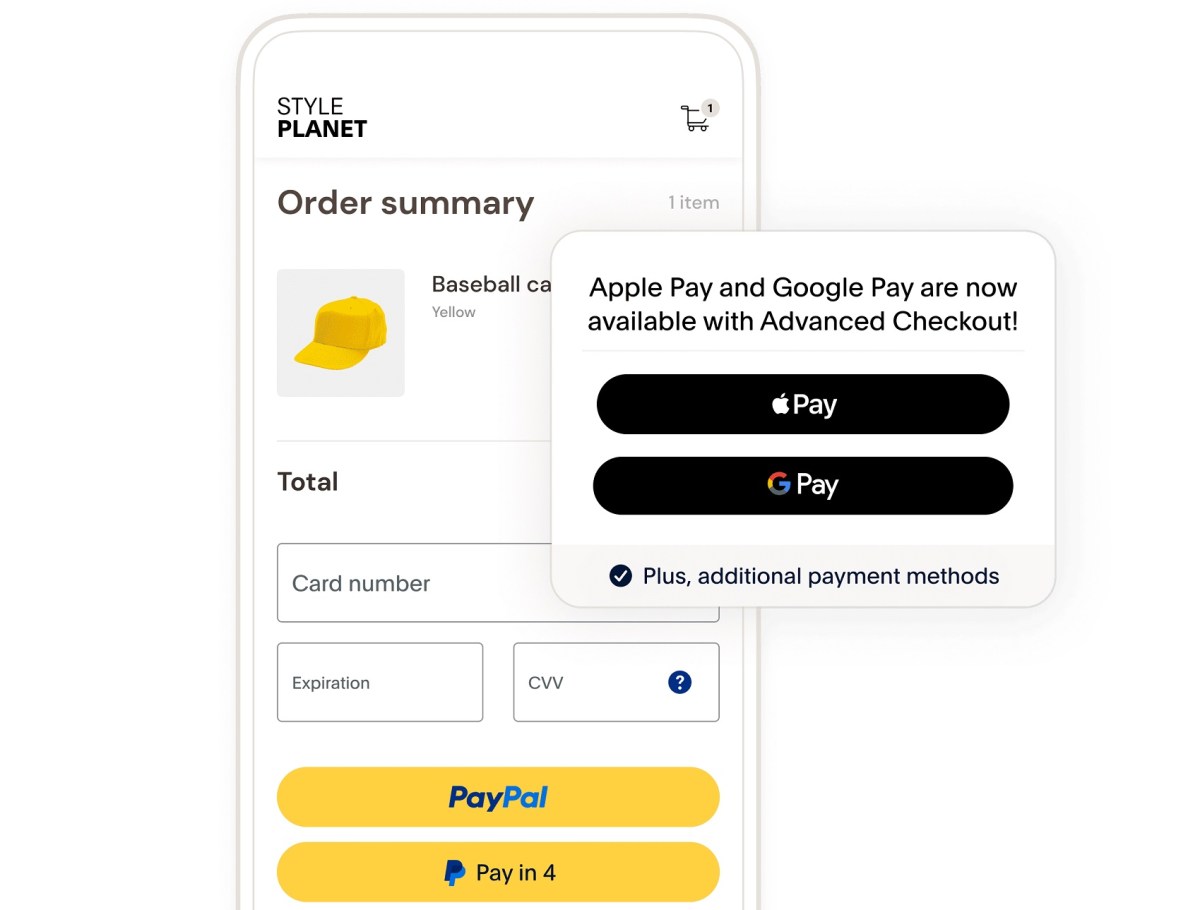

The new features include the ability for SMBs to accept Apple Pay, Google Pay, and other alternative payment methods, while allowing customers to save payment methods with the PayPal vault and keep cards up to date with real-time account updater. This enables a quick and easy checkout experience for customers and helps SMBs reduce card declines, drive conversion, and facilitate repeat buyers.

PPCP already allows SMBs to accept a range of payments including credit and debit cards, PayPal and PayPal’s BNPL solution, PayPal Pay in 4, which has no additional costs for PayPal merchants. PPCP also enables SMBs to customise the checkout experience to match the look and feel of their brand through a single integration.

Three in five (60%) Australians are more likely to make an online purchase if their preferred payment method is offered, while more than one-third (37%) say they’ve abandoned an online purchase because their preferred payment method was not available, according to the PayPal eCommerce Index 2023.

This is a real game changer for SMBs in Australia, according to PayPal managing director of Australia, Simon Banks.

“Our SMB customers can now do more with PayPal. PPCP lets small businesses access an extensive suite of tools all with one integration. This comes on top of PayPal’s highly secure platform, our PayPal Pay in 4 BNPL service, and other elements such as fraud, chargeback and seller protections that are available for businesses to access.”

PayPal has integrations with several ecommerce platforms – including Adobe Commerce, BigCommerce, and WooCommerce – which make it easier for customers to take advantage of selected PayPal Complete Payments new features.