Technology company, Stripe is helping businesses automatically calculate and collect sales tax, value-added tax (VAT), and goods and services tax (GST) in Australia and over 30 countries with the launch of Stripe Tax.

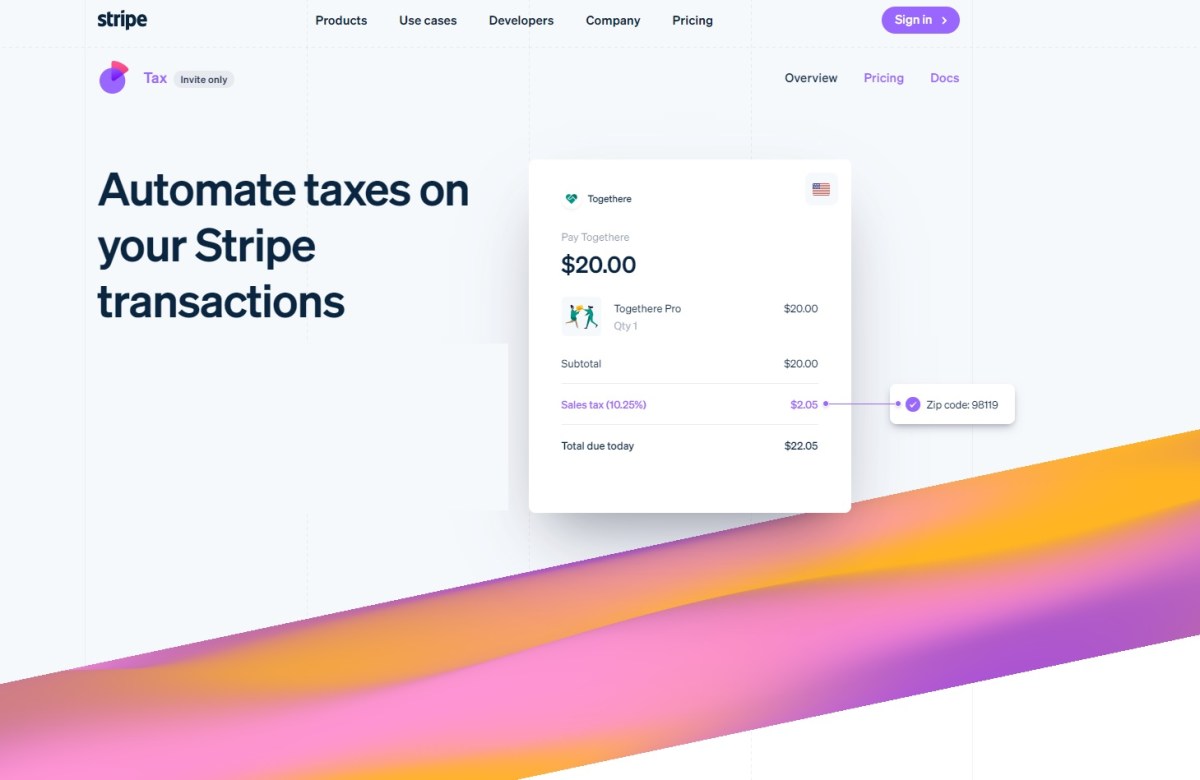

Stripe Tax automates tax calculation and collection for transactions on Stripe, tells businesses where they need to collect taxes, and creates comprehensive reports.

Features of Stripe Tax include real time tax calculation based on location, matching it to the product or service being sold and keeping up-to-date with rate and rule changes; frictionless checkout by using location information to calculate and show taxes to customers; tax ID management collects the tax ID number from customers and automatically validates VAT IDs for European customers; and comprehensive reports for each market to collect tax, speed up filing and remittance.

The above can be done automatically by adding a single line of code or updating a single setting in the Stripe Dashboard.

Stripe co-founder and president, John Collison said for most businesses, managing tax compliance is a painful distraction. “We simplify everything about calculating and collecting sales taxes, VAT and GST, so our users can focus on building their businesses.”

Stripe head of Australia and New Zealand, Mac Wang said simplifying tax compliance is one of the top concerns for Australian small businesses and startups looking to scale.

“It’s especially a deterrent for businesses that want to expand overseas, but struggle to navigate the complexities of tax compliance given how much it varies. Stripe Tax takes away the pain associated with tax compliance so our local customers can focus on what they do best.”

Assistance with tax compliance has been a top request from Australian Stripe users as GST rules in Australia are not uniform, and vary depending on the origin and makeup of a product. For example, GST does not apply to certain services and digital products provided within Australia by overseas businesses to Australian businesses, but GST applies to sales of imported services and digital products sold to Australian consumers.

Tax compliance is especially difficult for Australian businesses selling products overseas, with digital and physical goods now taxed in over 130 countries, and over 11,000 different tax jurisdictions in the US alone. Tax rules in each jurisdiction are updated frequently and often vary based on subtle details.