Global technology company, Stripe has launched Revenue Recognition to millions of users around the world, including Australia, built specifically for fast-growing businesses with subscription-based or recurring revenue models.

Recognising revenue is the process of mapping the money businesses make to the correct date/s on a balance sheet. For example, when a customer receives a product or uses a service, rather than when the customer made a payment. This is often a manual, inefficient, and error-prone process for finance teams.

Revenue recognition—a key part of GAAP (Generally Accepted Accounting Principles) standards—provides an accurate representation of profits and the ability to comprehend a company’s financials in a standardised fashion.

Maintaining accurate books under this standard can be especially complex for SaaS, subscription, and e-commerce companies, which are typically paid upfront for goods and services that will be delivered in the future or over an extended period of time.

For example, an e-commerce provider would recognise revenue not when a customer clicks purchase or when a product is shipped, but when a product is actually received by the customer. For a SaaS company, if a customer pays $120 for an annual subscription on January 1, that revenue would be recognised not on a single date, but as $10/month for the subsequent 12 months.

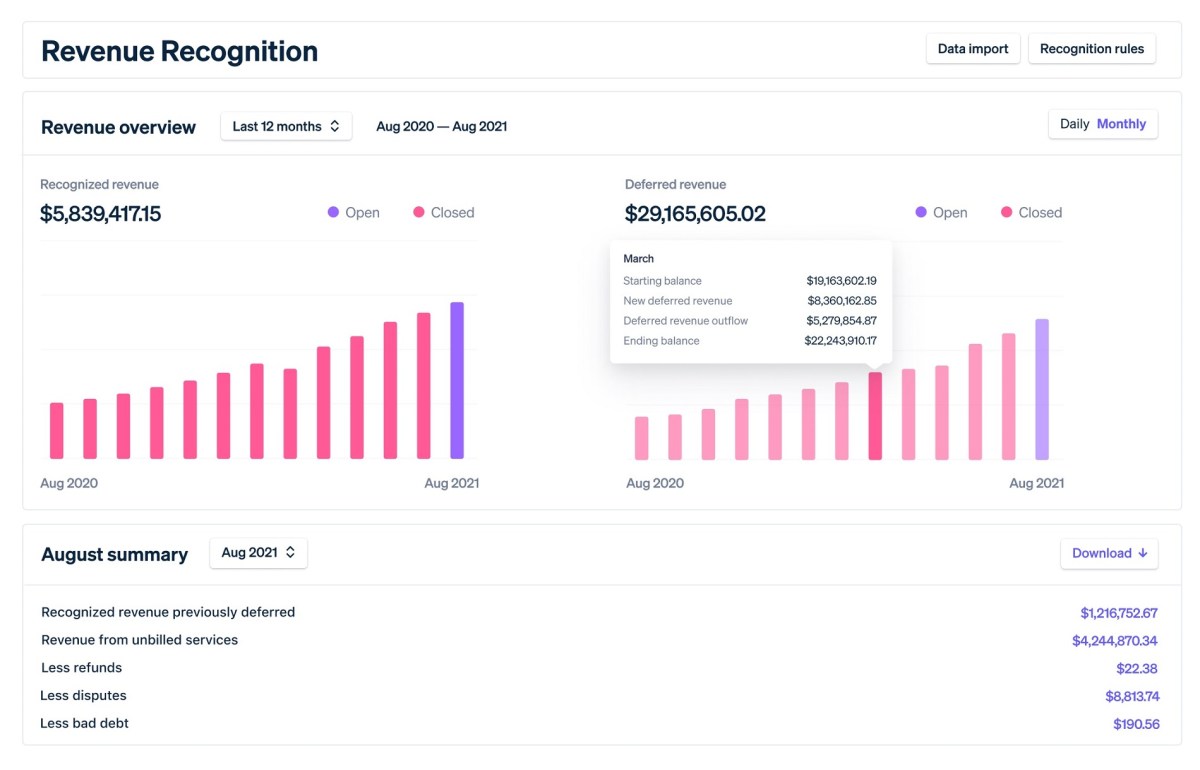

Stripe Revenue Recognition provides insightful reporting tools for balance sheets, income statements, revenue waterfall tables and more; automatic updates of transactions and payment changes, as well as expanded controls to account for deferred revenue, exclude certain types of revenue, pass through fees, and other accounting configurations.

Revenue Recognition does not require IT implementation and is fully integrated with Stripe’s payment platform, including Stripe Billing and Stripe Invoicing. With compliance support, businesses can achieve compliance with global standards like ASC 606 and IFRS 15 with audit-ready statements.

Stripe product lead, Vladi Shunturov described Revenue Recognition as a “big deal” because leaders don’t want to slow down for tasks that could be automated.

“I couldn’t be more excited to help founders, CFOs and finance teams automate their finance operations so they can spend their time and money where it matters. Thousands of early SaaS customers have been using Revenue Recognition to simplify accounting and automate revenue reporting as they scale new heights,” he said.