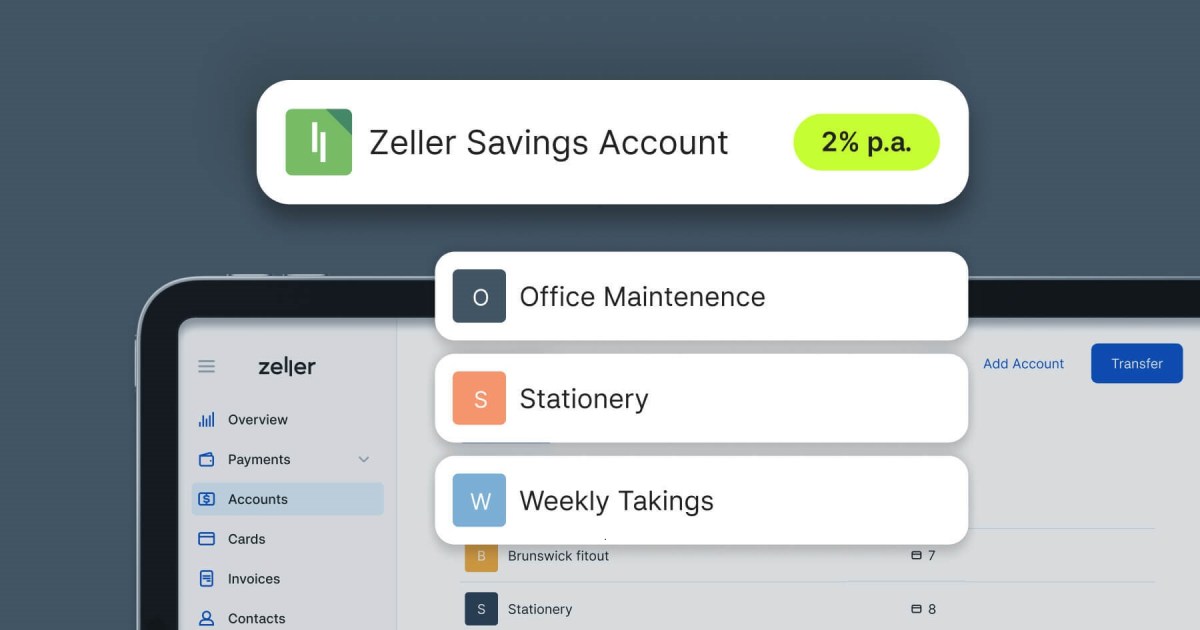

Australian fintech, Zeller has introduced the Zeller Savings Account, the latest addition to its growing suite of financial solutions and a product which was delivered from concept to launch in just eight weeks.

Zeller CEO and co-founder, Ben Pfisterer said, “The overwhelming response to our offering demonstrates the demand from Australian businesses for smarter, affordable, and innovative financial solutions.

“Our team is dedicated to rapid innovation, exemplified by the prompt development and delivery of the Zeller Savings Account. Zeller’s all-in-one financial solution meets the evolving needs of businesses, providing a new savings account option that offers a superior interest rate.”

In response to the lack of support for small businesses offered by the big four banks, Zeller has accelerated its product development to deploy new financial solutions in the past five weeks including Tap to Pay on iPhone, Virtual Terminal, Pay by Link, Corporate Cards, and the new Zeller Savings Account.

“Zeller’s agile, customer-centric products sharply contrast with the sluggish and complacent nature of traditional banks. We strongly advocate for investing in the growth of Australian small businesses and strive to bridge any gaps left by the big four for these business owners,” Pfisterer said.

With a Zeller Savings Account, Zeller merchants enjoy 2% p.a. for the first 60 days, then a competitive 1.4% p.a. standard variable rate after that — which outperforms all big four Australian banks.

Zeller Savings Account is designed to deliver a return to businesses with no minimum balance requirements. Savings can also be accessed anytime to be used as needed, empowering businesses to retain control of cash flow.

Existing customers can open a Zeller Savings Account with just a click, while new customers can sign up online in minutes.