Global payment and shopping service, Klarna has expanded its suite of marketing products and services to help retailers meet ecommerce growth and service the personalised recommendations sought after by customers.

Klarna’s enhanced range of marketing services means retailers do not need to source and create specialised content. Klarna combines various tools with a new, AI-powered Dynamic Ads function, to take a product feed from any merchant, recognise products, categorise, classify and then create bespoke images, leveraged by its recent acquisition of San Francisco based, Toplooks.

The images are high-impact and instantly shoppable via insertion of relevant messaging and payment options. They are dynamic and refresh every 30 minutes for merchants to display in-stock inventory, update messaging, as well as create, test, analyse, improve, and amplify at scale.

In association with this change, Klarna now offers comparison shopping services (CSS) available through Semtail, also recently required by Klarna for merchants to list their Google Product Listings Ads (PLAs) more efficiently.

Several brands have already benefited from using Klarna’s retail media services including global footwear brand, Clarks, which is using Toplooks’ patent-pending AI shoppable content engine to deliver customised marketing images across fashion, apparel, beauty, footwear, and home décor.

Speaking to Retailbiz in a recent interview, Klarna Australia marketing manager, Angus Sladden said it is exciting to bring something new to digital display advertising.

“Our Dynamic Ads AI engine follows over 100,000 influencers and we have accumulated a database of over 20 million items and 10 million looks in our ecosystem. Our AI engine can categorise, image recognised, and uses up to 100 different attributes to describe each apparel article,” he said.

“Additionally, we can remove the background on every single image, to standardise existing product feeds. Lastly, we clean up every image making them bespoke and beautiful. These steps plus applying our AI trained model creates the looks that users are served.

“We can take images from any existing product feed, for example Google or Facebook, and pair them with other individual images to deliver five or six different SKUs in one piece of imagery, which is different to anything else that exists. Based on user engagement, we can then roll in various backgrounds.

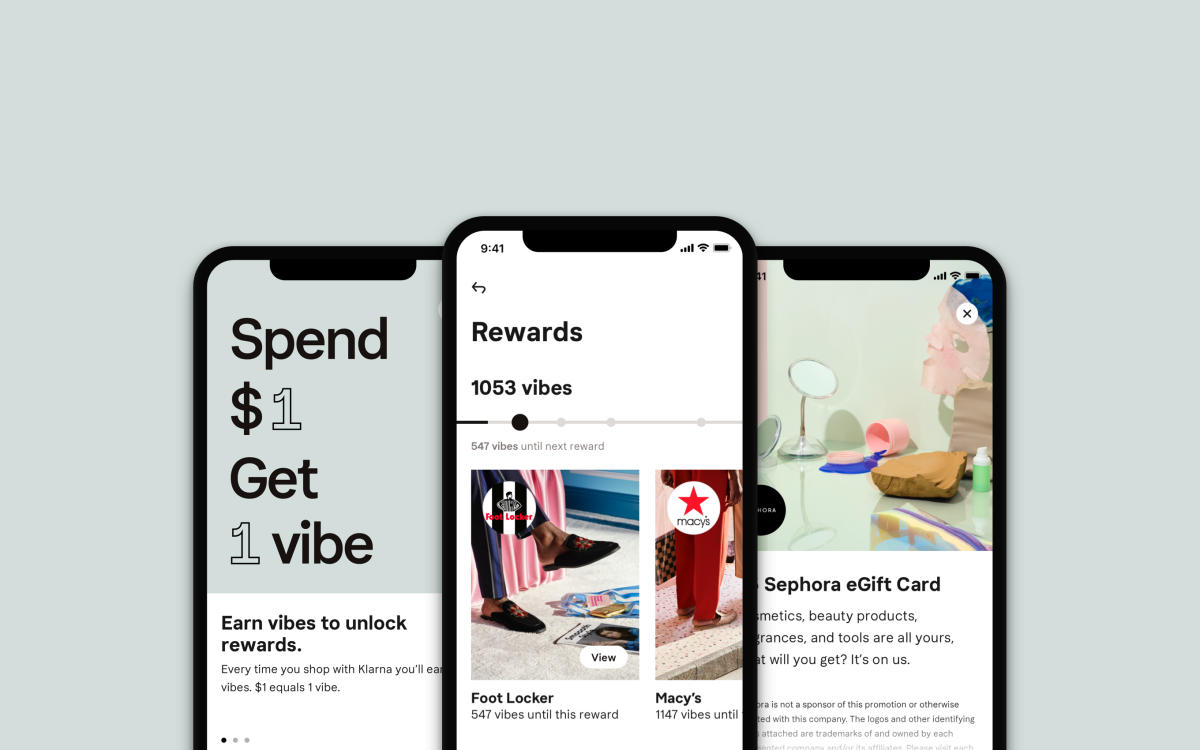

Klarna is serving these ads with brands or on behalf of brands in its own app where users can scroll through carousels and see dynamic ads rolling for personalised recommendations.

“The more information we collect, the more dynamic and personalised the ads will be. In our app, we strive for content to be meaningful because we want customers to click through, do research and see us a one-stop shop platform and then pay in four.”

In the initial stages, Klarna is testing the AI ad functionality with retail clients but has no hesitation is expanding to other verticals in the future. “It’s an easy plug and play integration that runs on an existing product feed, so no additional work is required,” Sladden said.

When asked about the accelerated shift to online shopping since the pandemic, Sladden acknowledged the significant growth and said it was important to differentiate from its competitors.

“Klarna has had a major focus on partnerships, a recent example is with Flybuys, to give customers something different. We want to engage them and drive them back to our service for their shopping needs.”

Klarna’s inaugural Shopping Pulse report has revealed that the overwhelming majority of Australians (91%) have shopped online in the past year. Although Australian shoppers expect to shop online more in the future, there is still a role for physical stores with more than half (54%) of respondents still preferring to shop in store. Further, Australia has the highest proportion of shoppers (63%) who shop weekly in-store of any international market.

Clothing and shoes are the most popular product category online, but based on experience in other markets, Klarna expects beauty, pharmaceuticals and accessories to be the next categories to increase their share online.

“At Klarna, bricks-and-mortar will always have a place in the market so it’s about how we connect online to B&M and how we improve value for brands. The experience across online and in-store must be consistent and seamless,” Sladden said.

On a final note, he said: “It’s exciting to bring something this agile and futuristic to the Australian market and I expect it to dominate the space.”