Robots could take out 6 million to 7.5 million retail jobs in the United States in the coming years, according to new research.

The report, which was commissioned by the Investor Responsibility Research Center Institute and conducted by Cornerstone Capital Group, found that a large portion of the retail workforce is at risk of becoming ‘stranded workers’.

Cashiers—73 per cent of whom are women—are at the highest risk of having their jobs made obsolete by robots as it is considered one of the most easily automatable jobs.

Around 16 million Americans are employed in retail, which represents 10 per cent of the nation’s working population.

Similar figures—although on a much smaller scale—can be seen in Australia, where around 1.3 million people are employed in the retail trade industry. This is roughly 11 per cent of the employed population.

What is driving automation in retail?

The report analysed 30 retailers—including Costco, Amazon, Target, Nordstrom, Wal-Mart, Whole Foods and Tiffany & Co.—and identified two key factors driving automation in retail: the growth of ecommerce and the increase in wages.

“Retail sales at brick-and-mortar stores, as well as margins on those sales, are increasingly constrained as consumers shift to online shopping,” it said.

“At the same time, many parts of the country are experiencing upward structural wage pressure as concerns about income inequality are gaining political traction.”

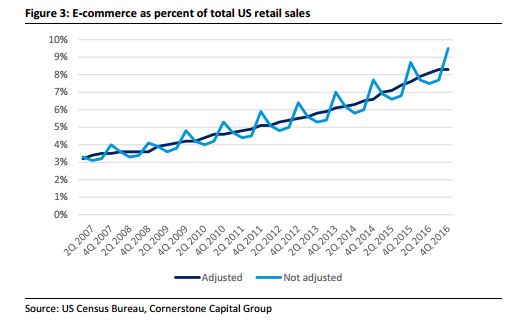

Ecommerce now accounts for more than eight per cent of total US retail sales, and Amazon’s continued success has put pressure on profit margins as traditional retailers attempt to keep up.

“Because Amazon avoids the occupancy costs of owning or leasing physical retail locations and the labor [sic] costs of staffing stores, Amazon can pass on its cost savings to consumers,” said the report.

“Lower prices and wider product selection enhance the customer experience, which drives traffic and attracts more sellers. This, in turn, fuels growth and allows Amazon to further drive down both costs and prices.”

The report said there are two strategies retailers could use to remain profitable:

- Convenience—focus on removing ‘friction’ from the purchase process in-store to increase sales volume and decrease labour costs through technology.

- Experience—focus on increasing consumer interaction with the store and employees to increase pricing power.

Examples of these would be an Amazon Go store for convenience and a Tiffany & Co. store for experience.

How will automation be used in retail?

The report said that the traditional layout of a retail store—with a shop floor, checkout, and backroom for inventory storage and store management—provides many opportunities for automation.

Self-checkout is perhaps the most obvious, with terminals already used by many retailers, reducing the number of staff needed.

“The concept is growing in popularity due to high consumer acceptance and the benefits it offers retailers in improving the customer experience,” said the report.

Examples of this include home improvement chain Home Depot, which says four self-checkout systems take the space of three traditional checkouts and eliminate the need for two cashiers.

Wal-Mart is testing ‘scan and go’ capabilities that would let a customer ring up his or her purchase with a smartphone and skip the checkout.

Then there’s Amazon’s Amazon Go store, which is checkout-free. The ‘just walk out’ technology automatically detects when products are taken from or returned to shelves and tracks them in a virtual cart.

When a customer is done shopping, she simply leaves the store, and her Amazon account is charged.

Automation also has wide ranging possibilities in inventory management and stock control. Technology like RFID (radio frequency identification) helps traditional retailers compete with online sellers because it enables frequent inventory counting. This, in turn, means greater accuracy.

The future

Cornerstone founder and CEO Erika Karp said that for retailers to succeed in the rapidly changing landscape they need to be engaging with the question of automation.

“Retailers are facing a perfect storm: they need to balance demand for wage increases with the negative optics of future job losses,” she said.

“The winners in retail will be companies that provide recruitment, retention and training for workers and innovate with forward-thinking future store strategies.”

Want the latest retail news delivered straight to your inbox? Click here to sign up to the retailbiz newsletter.